MEDICARE OPTIONS

When it comes to Medicare options, researching the best plan can be a daunting task. But with Tropical Health Insurance, it doesn't have to be. I take the hassle out of finding the right coverage by searching through thousands of plans from top companies to suit your needs and budget. Make a single call to me and I'll do the hard work for you. Contact Tropical Health Insurance today to learn more.

Medicare Explained

At Tropical Health Insurance, I understand the importance of having proper health insurance coverage, especially for those 65 and over. Medicare provides health insurance for individuals of this age group specifically. For individuals under the age of 65, there is coverage available, but specific qualifications must be met for those under 65.

If you are in this age group and looking to qualify for Medicare, I can help guide you through the process. Make sure you have the coverage you need by contacting me today.

Medicare is a great way to offset the cost of health care, however, it does not cover all medical expenses. It also does not cover the cost of long term care programs. For extra coverage, I can suggest a Medicare Supplement Insurance plan or a Medicare Advantage Plan that can help fill those coverage gaps.

MEDICARE PARTS

Social Security enrolls you in Original Medicare (Part A and Part B)

Medicare Part A (hospital insurance) is what helps to pay for hospital stays, as well as care at a skilled nursing facility for a certain period of time after an inpatient hospital stay. Part A can also cover the cost for certain home health or hospice care.

Medicare Part B (medical insurance) is what helps to cover general care from your doctors, home health care, outpatient services, durable medical equipment, and select preventive care.

Additional parts of Medicare (Run by private insurance companies) These companies must follow Medicare rules and guidelines.

- Supplemental (Medigap) can help to pay for Medicare out-of-pocket expenses such as your copayments, deductibles, or coinsurance.

- Medicare Advantage Plan (Formerly Medicare Part C) Encompasses all of Part A and Part B, as well as prescriptions, vision coverage, hearing coverage, and dental coverage.

- Medicare Part D (Medicare prescriptions) helps mitigate the cost of prescription drugs.

At Tropical Health Insurance, I want to ensure that all of my clients are informed about their healthcare options. If you're 65 or older and have paid Medicare taxes long enough, you may be eligible for free Medical hospital insurance (Part A). By paying a monthly premium, you can enroll in Medicare medical insurance (Part B) - but be aware that those with higher incomes may have a higher monthly cost.

MEDICARE- PART B CHOICES

You can enroll in Medicare Part A and Part B if you choose, but because Part B has a paid premium, you can opt out of Part B coverage.

If you are eligible for Medicare Coverage at age 65, your first enrollment period will begin three months before your 65th birthday. This includes the month that you turn 65, and it ends three months after your 65th birthday.

If you decide not to apply for Medicare Part B at the initial time of enrollment, you can still enroll at a later date, however, your benefits could be delayed. In addition to coverage delays, you may also have an increased premium. The increase in premium is 10% for each 12 month time period that you were eligible to enroll in Part B, but chose not to enroll. These increases can be waived if you qualify for a Special Enrollment Period.

Once your initial enrollment period has passed, you can sign up during a general enrollment time that happens between January 1st and March 31st. Your coverage would begin the month after you sign up.

If you do have medical insurance coverage from a group health plan from your or a spouse's employment, it is possible that you may not have to apply for Medicare Part B when you turn 65. You can potentially qualify for a "Special Enrollment Period" that will allow you to enroll for Part B given the following factors:

- You enroll in Part B in any month that you are still covered under the group health plan, and you or your spouse's employment continues.

- You enroll in Part B during the 8-month period that starts the month following your group health plan coverage ends OR the employment your coverage was based on ends. (Whichever comes first.)

At Tropical Health Insurance, I understand that starting Medicare benefits may not be the right choice for everyone turning 65. If you're within three months of this milestone, and need guidance on your options, contact me. I can help you make an informed decision.

HOW TO APPLY ONLINE

I get that retirement planning can be a daunting task. If you are approaching your 65th birthday and not quite ready to start receiving your monthly social security benefits, I have a solution for you. With an online Medicare application, you can easily sign up for Medicare and wait to apply for your retirement or spouse's benefits later. This process takes less than 10 minutes and can save you time and hassle. Don't let the stress of retirement planning overwhelm you - let Tropical Health Insurance simplify the process for you. Contact me today to learn more.

Medicare Advantage Plans

If you have Part A and Part B, you can enroll in a Medicare Advantage Plan (MAPD). MAPDs are offered by Medicare approved private companies. Every Medicare Advantage Plan has different out of pocket costs and rules. These rules can change each year. Most Medicare Advantage Plans cover additional benefits like prescription drugs, fitness programs and some dental, vision and hearing. MAPDs have a yearly maximum out of pocket, if you reach this amount, all other medical expenses are covered at 100%.

You also have the freedom to choose from a variety of health insurance plans and visit medical professionals you trust.

Get the coverage you need and the peace of mind you deserve with Tropical Health Insurance.

PREFERRED PROVIDER ORGANIZATION (PPO) PLANS

The most common reason for enrolling in a Medicare PPO is to have freedom to choose healthcare providers that are in or out of network.

PPO's are ideal if you want to have more of a selection on where to see your doctors and specialists. With these plans, you are able to seek care from any doctor, facility, or supplier that accepts Medicare whether they are in your network or not. (It is important to note that seeking medical care out of network can still incur higher copays) and higher maximum out of pocket.

HEALTH MAINTENANCE ORGANIZATION (HMO) PLANS

In Health Maintenance Organization plans, you are typically

locked into providers from within the given network. The

exceptions to this rule include:

- ER (Emergency Care)

- Out-of-area urgent care

- Temporary out-of-area dialysis treatments

If you get non- emergency healthcare out of the network, you may have to pay the full cost. If your doctor or health care provider leaves the plan. you will be notified so that you can select another provider within your network. It is important that you follow your plans rules.

MEDICARE SUPPLEMENT PLANS

As a senior, Medicare is likely a crucial part of your retirement budget. However, it's essential to remember that Medicare only covers about 80% of your expenses, leaving the remaining 20% to come out of your own pocket. This can be overwhelming, especially if you face a major medical need. Thankfully, there is a solution that can help you manage healthcare costs more effectively - Medicare Supplement plans. These plans give you the freedom to choose your doctors without needing a referral, offer predictable out-of-pocket expenses for Medicare-covered services, and provide nationwide coverage. Furthermore, they offer guaranteed renewability, meaning the insurance company can never drop you or change your coverage due to a health condition. It's worth exploring your Medicare Supplement options to ensure that you are fully covered and protected in your retirement years.

Take a look at some options below!

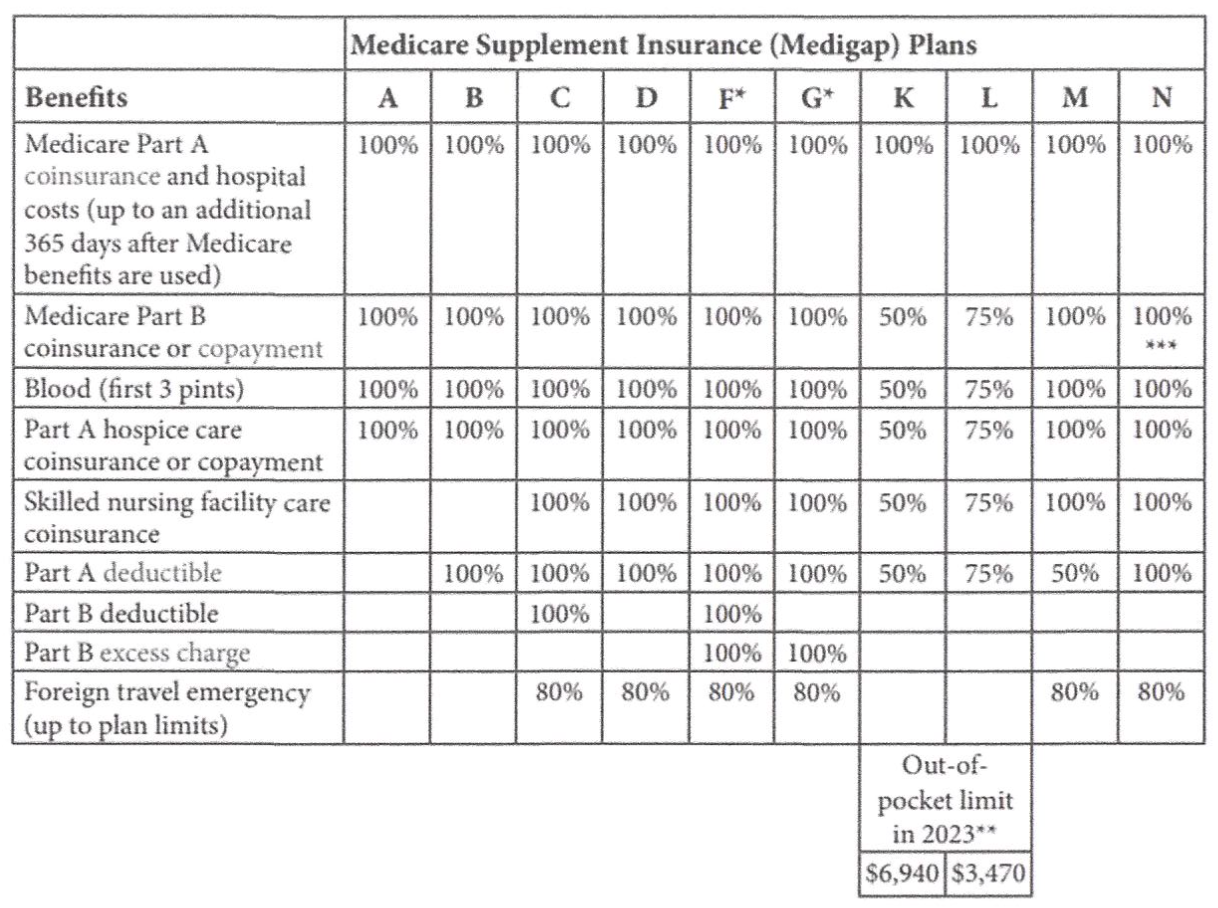

This chart shows basic information about the different benefits that Medigap plans cover. fIf a percentage appears, the Medigap plan covers that percentage of the benefit, and you must pay the rest. If a box is blank, the plan doesn't cover that benefit.

*Plans F and G also offer a high-deductible plan in some states (Plan F isn't available to people new to Medicare on or after January ,1 2020.) If you get the high-deductible option, you must pay for Medicare- covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,700 in 2023

before your policy pays anything, and you must also pay a separate deductible ($250 per year) for foreign travel emergency services.

**Plans K and L show how much they'll pay for approved services before you meet your out-of-pocket yearly limit and your Part B deductible ($226 in 2023). After you meet these amounts, the plan will pay 100% of your costs for approved services for the rest of the calendar year.

***Plan N pays 10% of the Part B coinsurance, except for a copayment of up to$20 for some office visits and up to a$50copayment for emergency room visits that don't result in an inpatient admission.

*We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.